kashway Loan APK v2.2.0

risine credit Limited

Instant mobile loans with fast approval and no collateral needed.

Emergencies can happen at any time, and quick access to cash can really help, whether you’re facing a medical bill, tuition fee, or another surprise expense. Traditional bank loans often take days or even weeks to process. Kashway Loan APK offers a faster solution.

Kashway makes borrowing simple, fast, and stress-free. It’s designed for people who need quick financial support without dealing with mountains of paperwork or long approval waits. Let’s explore how this app works, its features, and how you can use it safely and wisely.

What Is Kashway Loan APK?

Kashway Loan APK is a mobile loan application built for Android users. It allows individuals to borrow money directly from their smartphones, anytime and anywhere. Instead of visiting a bank, filling out forms, and waiting for approval, Kashway makes the process digital and instant.

The app is popular in countries like Kenya because it doesn’t require collateral. You can borrow funds without pledging any assets. All you need is your smartphone and valid identification. With Kashway, the whole borrowing process is right on your phone.

How Does Kashway Work?

Kashway’s process is simple and fully automated. After you install the app, you create an account by entering your personal and contact details. The app reviews your information, often using your mobile data history, to check your creditworthiness.

If you qualify, the money is deposited directly into your mobile money account within minutes. The approval is quick, and there’s no need for face-to-face meetings or lengthy verifications.

In simple terms:

- Download and install the app.

- Register your account.

- Apply for a loan.

- Receive instant cash in your wallet.

Key Features of Kashway Loan APK

1. Fast Loan Processing

No waiting in long queues or dealing with paperwork. Once your profile is verified, you can get your loan approved in less than a minute.

2. No Collateral Required

Kashway understands that not everyone has property or assets to offer as security. That’s why you can borrow funds purely based on your credit history and reliability.

3. Flexible Loan Amounts

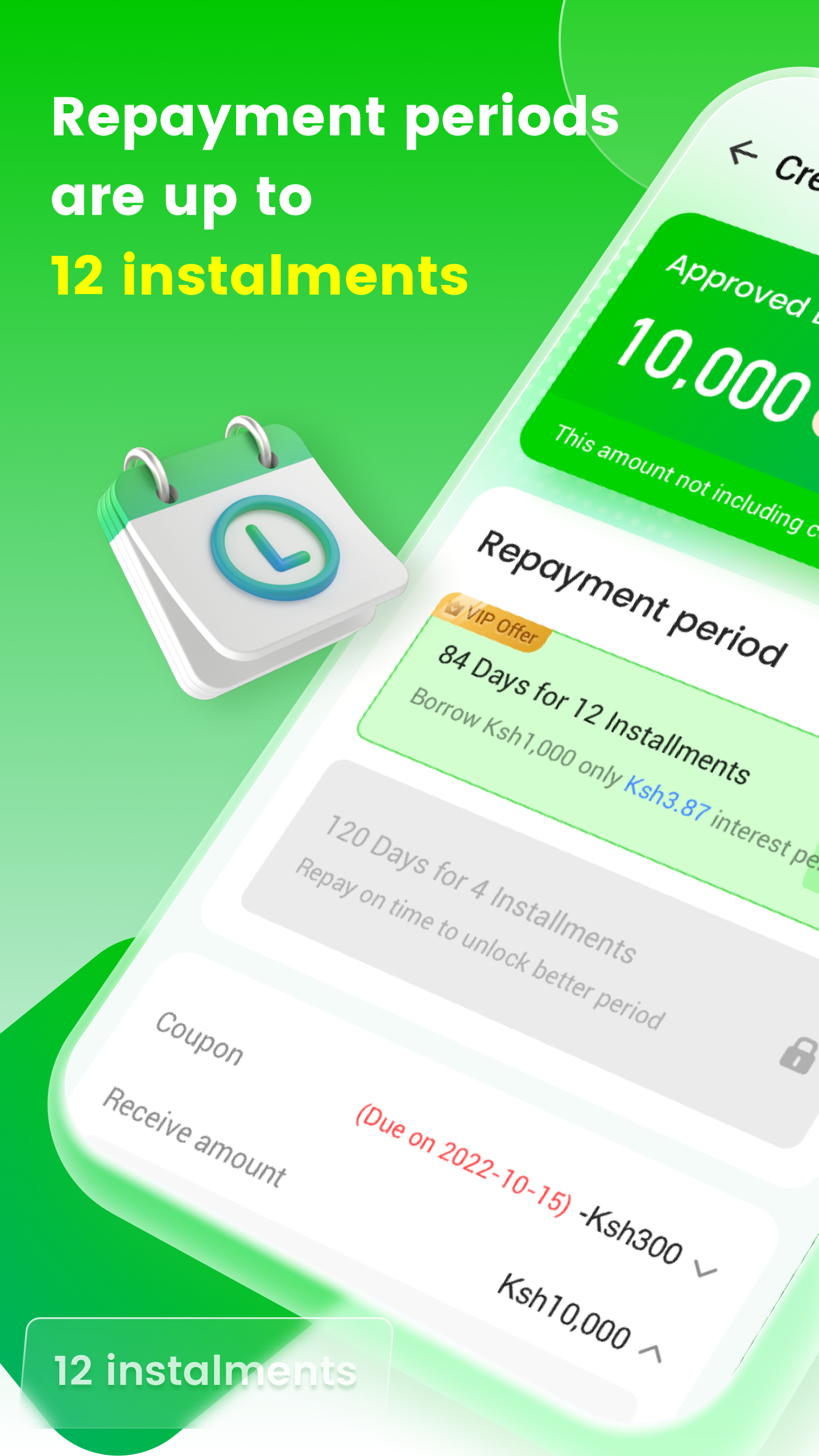

You can borrow small or large amounts, as long as it’s within the app’s limit. If you repay on time, your borrowing limit may increase over time.

4. Simple and Clean Interface

The app is built for everyone. Even if you’re not tech-savvy, the interface is intuitive, guiding you through every step.

5. Transparent Fees and Rates

You won’t find hidden charges here. Kashway clearly displays interest rates, repayment terms, and due dates, helping you make informed decisions.

6. Secure Transactions

Kashway uses data encryption to protect user information. Every transaction is confidential, ensuring your privacy and security.

Why Choose Kashway Loan?

Kashway stands out because it blends technology with accessibility. Here’s why thousands of users prefer it:

- Speed: Apply and receive funds in minutes.

- Convenience: Apply from anywhere without needing to visit an office.

- Trust: Transparent policies and reliable service.

- Support: 24/7 customer assistance for queries and repayment help.

It’s an ideal choice for those who value simplicity and reliability in financial services.

How to Install Kashway Loan APK

You can download Kashway Loan APK easily by following these steps:

- Enable Installation Permissions

Go to your phone’s settings → Security → Enable “Install from Unknown Sources.” This allows you to install apps outside the Play Store. - Download the APK File

Tap the Download button available on this page to get the latest Kashway Loan APK file. - Install the App

Once downloaded, open the file and follow the prompts to install it on your device. - Launch and Register

Open the app, enter your basic details, and create an account. - Apply for Your First Loan

After registration, you can apply for a loan and receive approval in just a few moments.

Note: Always download apps from trusted sources to ensure safety and authenticity.

Tips for Borrowing Responsibly

While Kashway makes borrowing easy, it’s essential to use it wisely. Here are a few simple but important tips:

- Borrow Only What You Need: Don’t take more than you can repay comfortably.

- Understand the Terms: Always read the loan agreement carefully so you know the repayment period and interest rate.

- Pay on Time: Timely payments improve your credit score and unlock higher borrowing limits.

- Avoid Overlapping Loans: Stick to one loan at a time to avoid unnecessary financial strain.

- Keep Communication Open: If repayment becomes difficult, contact support immediately. They may offer flexible repayment options.

Common Loan Issues and How to Handle Them

1. Loan Rejection

If your loan isn’t approved, don’t panic. It could be due to incomplete details or poor repayment history. Double-check your information and try again after a few days.

2. Late Repayments

Missing payments can affect your credit score. Set reminders or use auto-pay options if available.

3. Technical Glitches

If you face login or payment issues, clear your app cache or reinstall the app. Customer support is usually responsive and ready to assist.

FAQs about Kashway Loan APK

Q1: Is Kashway available on iPhone?

Currently, Kashway is designed for Android devices only. iOS users will need to wait for a compatible version.

Q2: What documents are needed for registration?

You’ll need a valid ID, an active mobile number, and sometimes proof of income for verification.

Q3: Can I apply for a second loan before clearing the first one?

No, you must complete repayment of your existing loan before applying again.

Q4: How long does approval take?

Most loans are approved within minutes, though first-time users might experience a short verification delay.

Q5: What happens if I repay early?

Kashway encourages early repayment—it can improve your credit standing and increase your loan limit for future borrowing.

Conclusion

Kashway Loan APK is redefining how people access short-term loans. It’s simple, secure, and convenient—ideal for emergencies or urgent financial needs. With no collateral requirements, quick approval, and transparent policies, it’s a smart choice for anyone who values flexibility and speed.

But remember, while borrowing can solve short-term problems, responsible repayment builds long-term stability. Use Kashway as a helping hand, not a habit.

Download the Kashway Loan APK today and take control of your financial journey—right from your phone.